Nat Gas Tycoons, AI Priests that bribe, corporate anthropology, and more

Issue #3 in an ongoing review series.

Nat Gas and its new Tycoons

“There is this fictional story about this boy in Texas that started with marbles and incrementally traded up to a used pickup truck…

That’s what we did.”

— Mike Sabel, co-founder of Venture Global LNG

RECENTLY, DANIEL YERGIN sat down for an interview with Dwarkesh Patel to discuss his books, his research and his very interesting life. Daniel is a very respected authority on international politics and energy and his most famous book The Prize, details the rise of oil as a powerful commodity that reshaped world history.

During the interview he made a notable comment around energy transition — the push away from fossil fuels into decarbonized energy sources:

That's one of the things in The New Map. If people read one part of it, read the section on energy transition. It tells you that what we're talking about today is not anything like any other energy transition. Every other energy transition we've had has been energy addition. Oil discovered in 1859 overtakes coal. Coal is the world's number one energy source in the 1960s. Last year, the world used more coal than it's ever used, three times as much as the 1960s. Now the idea is, can you change everything literally in 25 years?

…the development of solar is going to be really important. But things are not going to move in a straight line. We are in an energy transition, but it's going to be a longer one.

(source)

The energy transition trend is a major thesis, especially for people that make bets about where the world is headed. But betting on clean energy and hoping for stellar returns won’t cut it. We are still far away from a complete clean energy future, and the transition, like Yergin says, will be longer than we expect. As nations seek to meet their energy needs, they must balance energy security, and energy independence, and they cannot fulfill their domestic demands if they cut off all fossil fuels.

Naturally this raised a question for us. Who are the people poised to take advantage of this transition? Those that understand the value of carbon-based energy and the geopolitical power that it yields?

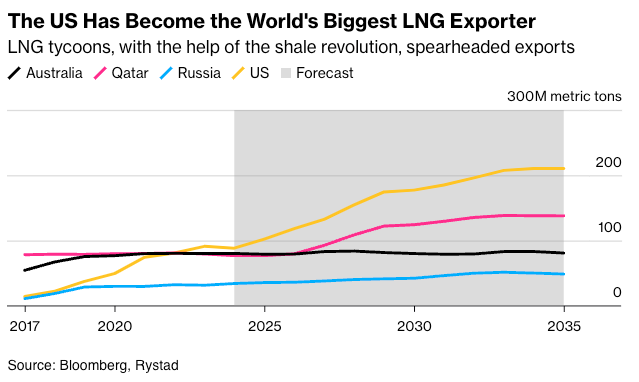

In June, Bloomberg reported on the story of Venture Global LNG, a “long-term, low-cost provider of U.S. Liquified Natural Gas sourced from resource rich North American natural gas basins”. The bet that the company is making hinges on the struggle defined above: countries will struggle going all-in on renewables, and must resort to other methods to sustain themselves while they transition.

Currently the U.S. has become the world’s biggest LNG exporter, and the shale revolution has turned people like Venture Global founders Mike Sabel and Bob Pender into tycoons. What’s most interesting is that these guys were industry outsiders:

They were industry unknowns but saw an opportunity. The existing LNG industry’s designs were too clunky, they thought. So they modified them to run using a larger number of smaller units, or trains. They chose a modular design, too, allowing factories to fabricate difficult pieces and later combine them like massive Legos on site, promising a faster ramp-up and less downtime for maintenance.

To gather early financing for the complex and very costly LNG plant infrastructure, they pitched their ideas to Shell, and eventually Shell signed a 20-year purchase agreement which helped attract other buyers. Sabel and Pender then brought those deals to the banks, which in turn gave them financing.

This market is worth keeping an eye on, especially since LNG is becoming a global leveraging tool. Here’s Yergin:

For [the Japanese], being able to import energy from the US is very critical to their energy security. Where else are they going to get their LNG? They'll get some from the Middle East, some from Australia, but they'll be pushed back to getting it from Vladimir Putin. For them, US energy exports, US shale, has become part of their energy security.

I did an event with the Japanese prime minister in the springtime. That came through very clearly. For them, US exports are part of the security relationship. US LNG is now part of the arsenal of NATO.

(source)

And now onwards to the rest of the piece.

In this issue:

AI Agents in Minecraft

Mineral Security Coalitions

Notetaking cultures in company building

Mini-Westworlds

Altera Playlabs, a startup based out of Menlo Park, recently released Project Sid, a Minecraft world with over 1,000 interactive AI agents powered by LLMs. Altera was a research lab led by Dr. Robert Yang, a computational neuroscientist from MIT, until 2023, after which they raised a pre-seed and seed round and set up shop with a “talent-dense team of computational neuroscientists, physics olympiads, and engineers from MIT EECS, Stanford NLP Group, Google X, Citadel, Supercell”. A pretty varied and intense team.

Their goal is to build advanced AI agents that coexist with us in virtual environments. According to the team, most AI Agents today lack certain fundamental human qualities (autonomy, coherence, emotion, episodic memory, fast processes, and grounded interactions) and using their background in neuroscience, they want to create machines that self-organize.

There’s a lot of philosophical musing on their Substack, about what it means to be human, understanding relational dynamics between agents, etc. With most AI shops today there’s always a philosophical bent to their narrative. After all, that is what helps them attract talent and funding. With Project Sid, their motivations are at least mildly interesting:

At Altera, our mission is to build digital humans. Our motivation for simulating societies comes from our observation that some of the most critical aspects of humanity are captured by interactions and relationships between people. So naturally, to build digital humans is to build agent societies.

If you’re creating a virtual world, and populating it with agents to see how they react, you’re fundamentally trying to understand how our own real society will shift and change under similar conditions. This is an act of prediction. Almost reminds us of Alex Garland’s show Devs, where technologists create a virtual world running on a quantum computer that maps onto the real world 1:1, hence giving them the ability to predict their own future.

Brad Slingerlend of NZS Capital echoed the same sentiment in his newsletter a while back:

Now, let’s go out a little further on the limb and speculate what might really be behind this euphoric FOMO GPU land grab. What’s the real pot of gold that these billionaire tech CEOs might be after? My candidate is: predicting the future. I discussed this in more detail in my longer post titled Simulacrum a few months ago. Effectively, AI is going to give us the ability to simulate countless realities in parallel, and, in doing so, will create a new type of modeling and virtual forecasting. Remember when sports books were using video games of professional teams programmed with player stats to gauge who might win real-world games? Now expand that concept until you get to a “game” that predicts the entire world on a day-to-day (or longer-term) basis... Ultra-powerful AI holds the promise of a real Laplace’s Demon with perfect knowledge of the past, present, and future…

(source)

Regardless of the final outcome, the current iteration of the virtual world is in Minecraft, where their AI agents operate autonomously for hours or days without human intervention, developing their own government, economy, culture, and religion. A funny moment in the demo video: the agents established a market to trade gems, but instead of the merchants trading the most, it was the priest, who was bribing townsfolk to convert.

Mineral Security

The story of humanity – evolution of our species, the prehistoric shift from foraging to permanent agriculture, rise and fall of antique, medieval and early modern civilizations, economic advances of the past two centuries, mechanization of agriculture, diversification and automation of industrial protection, enormous increases in energy consumption, diffusion of new communication and information networks and impressive gains in quality of life – would not have been possible without an expanding and increasingly intricate and complex use of materials.

— Vaclav Smil, “Materials and Dematerialization”

The FT reports today that Western allies are forming a new coalition to combat China’s chokehold on the critical mineral required for high-tech advancement:

The Minerals Security Partnership, a coalition of 14 nations and the European Commission, will unveil a new financing network at an event in New York on Monday as they try to ramp up international collaboration and pledge financial support for a huge nickel project in Tanzania, backed by mining company BHP.

China controls 50%+ of the world’s processing capacity for lithium, cobalt and nickel which are used to make EV batteries. Plus, Chinese influence also extends to other nations via their investments into mining projects, such as in Indonesia, a growing exporter of Nickel. It would be interesting to see the dynamic between U.S. backed enterprises, Chinese-backed enterprises and host countries as they play a three-way game of grand strategy via economic coordination.

A new minor detail that was new to us: China has also restricted export of antimony, an obscure metal used in armour-piercing ammunition and night vision goggles. This reminded us of an FT report in early June about the debut of French company Exosens, which makes night vision goggles. Shares of the company jumped 17% amid rising interest from armed forces due to the regional conflicts around the world, and even Teledyne was interested in acquiring the company at one point.

These two things are at the perfect confluence of our current geopolitical moment. We’ll see how this evolves.

Mortimus Recommends

Being Non-Consensus and Right in VC with Jason Shuman & Will Quist (source). This episode is part of Origins, a podcast about the LP-GP relationship in VC. This time the hosts had Primary Venture’s Jason Shuman and Slow Venture’s Will Quist on as guests. Both are young and unique individuals in VC, with completely different approaches. We took lots of notes when Jason spoke about Primary’s Impact team (also called a platform team, or value creation team) which creates meaningful outcomes for their portfolio companies (like converting more outbound sales call compared to in-house SDRs, or doing intense recruiting and building infrastructure alongside the startup). Worth listening to.

Miscellaneous: Avid Notetaking

We’ve been pondering the ‘meticulous’ note taking approach of Charles Hill and trying to figure out where else it should be used today. For those who don’t know Mr. Hill, he was a professor at Yale and one of the three ‘co-founders’ of Yale’s Grand Strategy program. He was also, (according to biographer Molly Worthen) a ‘deeply brazen generalist’:

“He believed that a person who wants to understand must probe at bookshelves like a scavenging shorebird, reading anything available on the centuries of history, literature and philosophy that lie beneath and around the subject at hand. One must pay close attention to every detail of text and experience, he believed, and then find a clean way through, without getting lost in the details.” (source)

To make sense of the world, Charles Hill would make notes of everything; every conversation, every idea, every notion. When he worked with George Shultz at the State Department, he produced over 20,000 notebook pages worth of notes. Being the pre-eminent documentarian gave him a deeper insight into how his institution worked. Worthen writes:

He made himself indispensable as the State Department’s chief amateur anthropologist who always produced the most credible narrative, who understood the power of putting things into words. Taking notes, writing speeches, and drafting memos meant that “you became a policymaker,” [Charles Hill] later said.

So where can we use this meticulous note taking approach?

Well, most startups and firms would probably benefit from having an internal writing practice. Here’s a great breakdown of the writing culture at Stripe, where internal documentation and blog post writing is a prized asset. Similarly, Amazon has a writing practice, so did Microsoft in Bill Gates’ era, where writing and notes became the equivalent of the company’s digital nervous system.

We’ve been experimenting with keeping detailed decision notes in our own workplaces, but are curious to here how others are implementing this idea. Shoot us an email if you’ve got great anecdotes.

That’s it for this week. Onwards to Consilience!